News

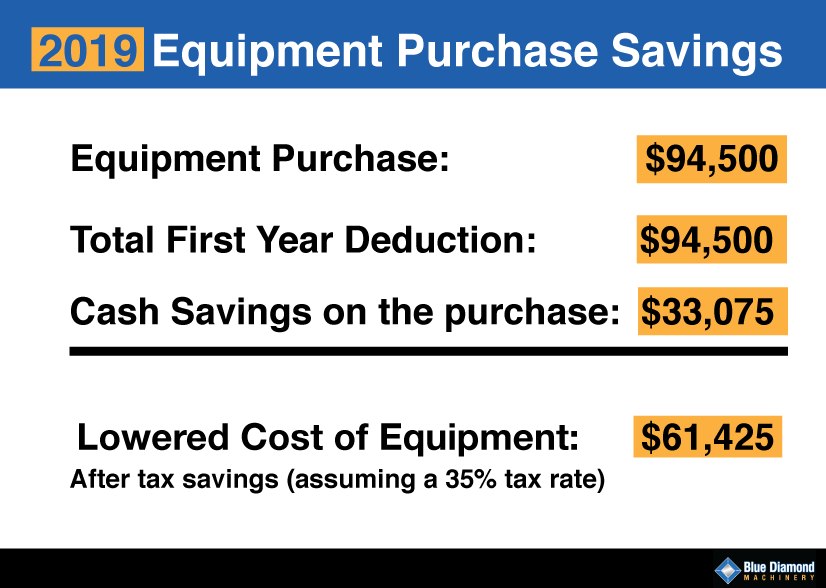

The government is offering big tax deductions for used construction equipment purchases.

If you bought used construction equipment in 2019 or plan on buying used heavy equipment over the next three years, you may be in for a nice tax break. Contractors are not only able to receive a tax break for new construction equipment purchases, but they're also able to receive a tax break for used construction equipment purchases as well.

The details of the law:

When the new tax code overhaul was signed into law in December, 2017, many construction business owners were excited about several of the changes that appeared in Section 179, including:

- A first-year bonus equipment deduction that would include, for the first time, used construction equipment

- A first-year bonus equipment deduction that increased from "50 percent to 100 percent of its cost." This means buyers can write off the entire cost of the machine the first year they purchase it instead of deducting the cost little by little over the course of several years.

- An increase in the maximum equipment depreciation deduction allowance - From $500,000 to $1 million.

- An increase in the maximum equipment purchase allotment—From $2 million to $2.5 million.

Who can take advantage of the deduction:

According to Section 179.org, those who qualify for the deduction include "all businesses that purchased, financed, and/or leased new or used business equipment during tax year 2019." This is assuming they spend less than $3,500,000.

The types of equipment that you can write off under Section 179:

- All construction equipment or heavy machinery bought for business use

- Business vehicles (weight must exceed 6,000 lbs)

- Certain improvements made to business buildings (for example, security systems, HVAC and roofing).

- And more. For complete details, we recommend visiting: section179.org.

Final Note:

While the law isn't without some qualifiers—Some states, like California, for example, handles bonus depreciation differently—the changes are largely beneficial for contractors, espcially small businesses.

Of course, you'll want to run this advice by your tax accountant first to make sure you qualify before taking action. We at Blue Diamond Machinery are not US tax experts. We prefer to stick with what we know best—renting and selling top-notch heavy equipment.

That said, you can read about the tax law changes in detail at Section179.org.

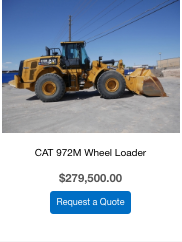

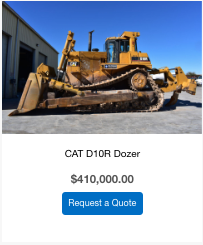

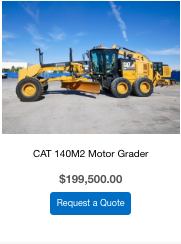

Our equipment for sale:

Start preparing for your tax right-offs now. You have until December 21 of this year to make a purchase.

View our complete listing on our Used Heavy Equipment for Sale page.

FREE Guide to Buying and Selling Heavy Equipment

Enter your details to receive our complimentary ebook